Blog

Keiser Private Loans: Your Path to Student Loans and Forgiveness

Keiser Private Loans

Keiser Private Loans are a type of student loan offered by Keiser University to help students finance their education. These loans are different from other student loans in terms of eligibility requirements, loan amount, and repayment options.

What is Keiser Private Loans?

Keiser Private Loans are a financial aid option provided by Keiser University to assist students in paying for their education. These loans are not subsidized by the government like federal student loans, and they are offered by private lenders.

How does Keiser Private Loans differ from other student loans?

Unlike federal student loans are not based on financial need. They are available to students regardless of their financial situation. Also have different eligibility requirements and loan terms compared to federal loans.

What are the eligibility requirements for Keiser Private Loans?

To be eligible for Loans, students must meet certain criteria set by the lender. This may include being enrolled at Keiser University, maintaining satisfactory academic progress, and meeting any credit or income requirements set by the lender.

How much can I borrow with Keiser Private Loans?

The loan amount that students can borrow with varies depending on factors such as the cost of tuition, the student’s financial need, and the lender’s policies. Students should consult with the Keiser University financial aid office or the lender to determine the maximum loan amount they are eligible for.

How to apply for Loans?

Applying for involves following a specific application process. Students should gather all the necessary documents, such as proof of enrollment and financial information. They will then need to complete the loan application form and submit it for review.

What is the application process for Keiser Private Loans?

The application process typically involves the following steps:

- Complete the loan application form.

- Provide any required documentation, such as proof of enrollment and financial information.

- Submit the application and documents for review.

- Wait for the lender’s decision on the loan application.

Are there any scholarships or grants available through Private Loans?

Keiser Loans do not offer scholarships or grants directly. However, Keiser University may have its own scholarship and grant programs that are separate from the loan offerings. Students should inquire with the Keiser University financial aid office about any available scholarships or grants.

Can I apply for Keiser Loans if I have federal student loans?

Yes, students can apply for Loans even if they have federal student loans. These are a separate financial aid option and do not affect a student’s eligibility for federal student loans. However, it is important to consider the terms and interest rates of both types of loans before making a decision.

How does Keiser University loan forgiveness program work?

Keiser University offers a loan forgiveness program to help students manage their student loan debt. The program is designed to provide financial assistance to eligible graduates who may have difficulty repaying their loans after completing their education at Keiser University.

Who is eligible for Keiser University loan forgiveness program?

Eligibility for this typically determined by factors such as the type of loan and the borrower’s financial need. Students must meet certain criteria to be considered for loan forgiveness, such as having a certain income level or working in a specific field.

What are the requirements for Keiser University loan forgiveness program?

The requirements for forgiveness program vary depending on the specific program and loan type. Students may need to meet certain income thresholds, make consistent loan payments, or fulfill certain employment obligations to qualify for loan forgiveness.

How can I apply for loan forgiveness program?

To apply for forgiveness program, students should contact the Keiser University financial aid office for information and guidance. The office will provide the necessary instructions and assist students in completing the application process.

What are the benefits of Keiser Private Loans?

Keiser Private Loans offer several benefits to students:

- Flexibility: Provide students with flexible repayment options and terms.

- Loan management: offers tools and resources to help students manage their loans effectively.

- Non-federal option: Available to students who may not qualify for federal student loans.

How does Keiser Private Loans help students manage their loans?

Keiser Forgiveness Loans provide students with access to online loan management tools and resources. These tools can help students keep track of their loan balances, payments, and repayment options. Additionally, Keiser Forgiveness Loans may offer loan counseling services to assist students in making informed decisions about their loans.

What financial services are offered by Keiser Private Loans?

In addition to loan offerings, Keiser Private Loans provide various financial services to students. These may include financial literacy resources, debt management counseling, and assistance in understanding loan repayment options.

Are Keiser Private Loans available only to Keiser University students?

Yes, these are specifically available to Keiser University students. These loans are designed to help students finance their education at Keiser University and may have eligibility requirements that are specific to Keiser University students.

Are there alternatives to Keiser Forgiveness Loans?

Yes, there are other private loan lenders available to students. These lenders may offer similar loan products with different terms and interest rates. Additionally, federal student loans are another alternative to Keiser Private Loans.

What other private loan lenders are available to students?

There are several private loan lenders available to students, including banks, credit unions, and online lenders. Students should research and compare the terms and interest rates offered by different lenders before making a decision.

Are federal student loans a better option than Keiser Private Loans?

Whether federal student loans or Keiser Forgiveness Loans are a better option depends on the individual student’s circumstances. Federal student loans may offer certain advantages, such as lower interest rates and more flexible repayment options. However, Keiser Private Loans may be a viable option for students who do not qualify for federal student loans or who need additional funding.

What is the difference between federal student loans and private student loans?

The main difference between federal student loans and private student loans is that federal student loans are subsidised by the government, while private student loans are offered by private lenders. Federal student loans typically have fixed interest rates and more flexible repayment options, while private student loans may have variable interest rates and different repayment terms.

-

Mod6 months ago

Mod6 months ago10 Komban Bus Skin Download – Livery HD Download

-

Mod8 months ago

Mod8 months ago25 Bus Simulator Indonesia Livery – HD Download

-

Mod8 months ago

Mod8 months ago10 Best Tamil Nadu Bus Livery – Mod HD Download

-

Life Style2 years ago

Life Style2 years agoLove Failure Images – 1000 Love hate images for download

-

Blog8 months ago

Blog8 months ago24 Girls WhatsApp Number for Chatting and Friendship

-

Mod10 months ago

Mod10 months ago10 Tamil Nadu private bus livery download

-

Entertainment1 year ago

Entertainment1 year agoAll Movies Hub 2023 Download Latest HD Movies, Web Series

-

Entertainment9 months ago

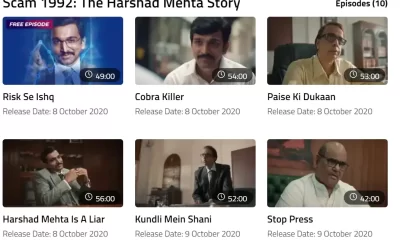

Entertainment9 months agoScam 1992 Web Series Download Google Drive HD