How to Make Money Trading with Candlestick Charts PDF

How to Make Money Trading with Candlestick Charts PDF: As a trader, the goal is always to make as much profit as possible. To do so, it is essential to understand the various tools and techniques available for trading. One such tool is the candlestick chart. Candlestick charts are widely used in trading, and for good reason. They are a powerful tool for analyzing market trends and identifying potential trading opportunities. In this comprehensive guide, I will walk you through the basics of trading with candlestick charts and share some tips on how to use them to unlock your profit potential.

Introduction to candlestick charts

Candlestick charts are a type of financial chart used to represent the price movements of an asset. They are made up of individual candlesticks that provide information about the price movement of an asset over a specific time frame. Candlestick charts are widely used in technical analysis and are popular among traders due to their ability to provide a visual representation of market trends.

Candlestick charts consist of a body and wick. The body represents the opening and closing prices of the asset, while the wick represents the high and low prices. The color of the body indicates whether the asset’s price has gone up or down. A green candlestick indicates that the closing price is higher than the opening price, while a red candlestick indicates the opposite.

Understanding the basics of trading with candlestick charts

To effectively trade with candlestick charts, it is essential to understand the different types of candlesticks and what they represent. There are several types of candlesticks, including doji, hammer, engulfing, and shooting star, to name a few. Each candlestick represents a different market trend, and understanding them can help you make more informed trading decisions.

One of the key benefits of using candlestick charts is their ability to provide a visual representation of market trends. By looking at the chart, you can quickly identify whether the market is bullish or bearish. A bullish market is characterized by an upward trend, while a bearish market is characterized by a downward trend.

Benefits of using candlestick charts for trading

There are many benefits to using candlestick charts for trading. One of the most significant benefits is their ability to provide a clear visual representation of market trends. This makes it easier for traders to identify potential trading opportunities and make more informed trading decisions.

Another benefit of using candlestick charts is their ability to provide valuable insight into market sentiment. The color of the candlestick body provides information about whether buyers or sellers are in control of the market. A green candlestick indicates that buyers are in control, while a red candlestick indicates that sellers are in control.

Common candlestick patterns and their significance

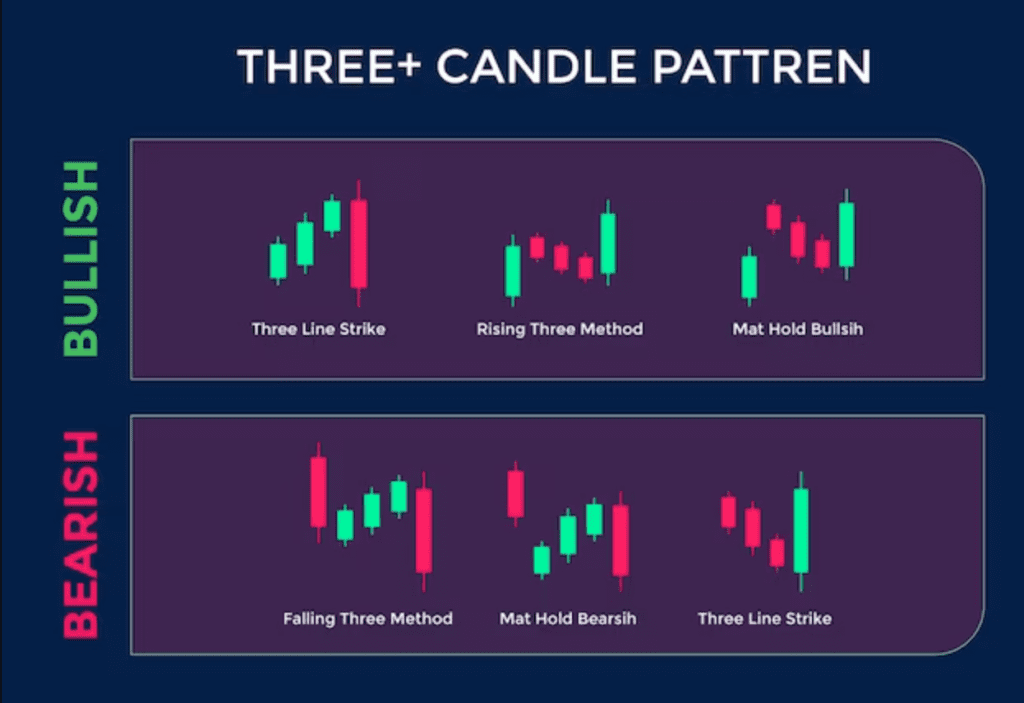

There are several common candlestick patterns that traders should be aware of. These patterns provide valuable insight into market trends and can help traders identify potential trading opportunities. Some of the most common candlestick patterns include doji, hammer, engulfing, and shooting star.

A doji candlestick pattern is formed when the opening and closing prices are the same. This pattern indicates that the market is indecisive and can signal a potential reversal. A hammer candlestick pattern is formed when the opening and closing prices are close to the high of the day and the wick is at least twice the size of the body. This pattern indicates that buyers are in control and can signal a potential reversal.

How to Make Money Trading with Candlestick Charts PDF

Analyzing candlestick charts requires a combination of technical analysis and fundamental analysis. Technical analysis involves using chart patterns and technical indicators to identify potential trading opportunities. Fundamental analysis involves analyzing economic and financial data to determine the underlying value of an asset.

To analyze candlestick charts, traders should start by identifying key support and resistance levels. Support levels are areas where buyers are likely to step in and prevent prices from falling further. Resistance levels are areas where sellers are likely to step in and prevent prices from rising further.

Developing a trading strategy using candlestick charts

Developing a trading strategy using candlestick charts requires a combination of technical analysis and risk management. Traders should start by identifying key support and resistance levels and using technical indicators to identify potential trading opportunities. They should also implement risk management techniques such as setting stop-loss orders to limit their potential losses.

Risk management techniques for trading with candlestick charts

Trading with candlestick charts can be risky, and it is essential to implement risk management techniques to limit potential losses. One such technique is to set stop-loss orders. Stop-loss orders are orders placed to automatically sell an asset when it reaches a certain price level. This can help limit potential losses and protect traders from significant market fluctuations.

Another risk management technique is to diversify your portfolio. Diversifying your portfolio involves investing in a variety of different assets to spread out your risk. This can help protect you from significant losses if one asset performs poorly.

Recommended resources for learning more about candlestick chart trading

There are many resources available for traders looking to learn more about candlestick chart trading. Some of the best resources include online courses, books, and webinars. Online courses are an excellent way to learn about the basics of Make Money Trading with Candlestick Charts, while books provide a more in-depth look at the topic. Webinars are also a great way to learn from experts in the field and ask questions in real-time.

Also read: Can I Have Spectrum at Two Addresses?

The importance of having a comprehensive guide in PDF format

Having a comprehensive guide in PDF format can be a valuable resource for traders. PDF guides are easy to access and can be read on any device. They provide a comprehensive overview of trading with candlestick charts and can be a valuable reference tool for traders.

Conclusion: Unlocking profit potential with candlestick charts PDF

In conclusion, Make Money Trading with Candlestick Charts can be a powerful tool for unlocking your profit potential. By understanding the basics of candlestick chart trading and using the right techniques and tools, you can make more informed trading decisions and limit potential losses. Whether you are a beginner or an experienced trader, there are many resources available to help you learn more about candlestick chart trading. So start exploring today and unlock your full profit potential with candlestick charts!

-

Mod6 months ago

Mod6 months ago10 Komban Bus Skin Download – Livery HD Download

-

Mod8 months ago

Mod8 months ago25 Bus Simulator Indonesia Livery – HD Download

-

Mod8 months ago

Mod8 months ago10 Best Tamil Nadu Bus Livery – Mod HD Download

-

Life Style2 years ago

Life Style2 years agoLove Failure Images – 1000 Love hate images for download

-

Blog8 months ago

Blog8 months ago24 Girls WhatsApp Number for Chatting and Friendship

-

Mod10 months ago

Mod10 months ago10 Tamil Nadu private bus livery download

-

Entertainment1 year ago

Entertainment1 year agoAll Movies Hub 2023 Download Latest HD Movies, Web Series

-

Entertainment9 months ago

Entertainment9 months agoScam 1992 Web Series Download Google Drive HD